ALS Limited delivered a resilient H1 FY24 financial result1 with Underlying NPAT2 above top-end of guidance range

asx/media release (ASX: ALQ)

- Delivered strong revenue growth, with underlying continuing revenue of $1,285 million, an increase of 7.4% (3.6% at constant currency (ccy)) due to strong performances within the Environmental, Metallurgy, Inspection and Oil & Lubricants (formally Tribology) businesses and supplemented by acquisitions made within the Life Sciences division.

- Statutory net profit after tax (NPAT) of $134 million, a decrease of 9.4%, impacted by the underperformance of Nuvisan business, increased one-off items, and disposal of the Asset Care business.

- Delivered industry leading EBITDA margin of 25.9%

- Underlying EBIT from continuing operations of $245 million, a slight decrease of 1.0%.

- Maintained industry leading operating margins of 19.1%, a contraction of 126 bps (at ccy), reflects the challenging economic environment and reduced new product development for the

- Pharmaceutical business. Margin contraction was partially offset by strong performances within Environmental and a resilient Geochemistry performance.

- Exceeded guidance (provided in July 2023) with underlying continuing NPAT of $158 million3, above the top-end of guidance range by 2.2%.

- Maintained world class health and safety outcomes, achieving 10% reduction on TRIFR YTD4.

- Maintained or improved ratings for 3 out of 4 ESG rating agencies.

- Executed 6 acquisitions5, contributing $36 million of revenue on a full year run-rate basis.

- Strong cash conversion (82% of underlying EBITDA) improved by 241 bps vs. pcp.

- Strong balance sheet supporting disciplined growth agenda, with 2.0x leverage ratio and available liquidity of $486 million.

- Underlying continuing earnings per share (eps) of 32.7 cents per share (cps), down 2.1%. Statutory EPS of 27.6 cps, down 9.6%.

- Interim dividend of 19.6 cps (partially franked to 20%), a decrease of 0.7 cps (3.4%) compared to H1 FY23, representing a payout ratio of 59.9% of H1 FY24 underlying NPAT.

ALS Chairman Bruce Phillips commented, “This was a good performance by our global business given the very challenging market backdrop of uncertainty in the geopolitical and economic environment. Underlying NPAT exceeded the top end of our market guidance as the Company continues to demonstrate the value of its resilient hub and spoke operating model. The operating performance, our strong financial position and a positive outlook supports the declaration of a 19.6 cps dividend for our shareholders. Pleasingly, this has been achieved whilst increasing our investments in quality growth opportunities during the first half of the fiscal year.”

CEO and Managing Director, Malcolm Deane commented “The Group has delivered strong revenue growth and maintained industry leading operating margins despite challenging trading conditions. The Group has maintained a strong balance sheet, high cashflow generation, and delivered scope growth while also maintaining its disciplined capital allocation framework in-line with the FY2027 vision.”

“During H1 FY24, our Commodities division has continued to demonstrate that it is a key enabler and benefactor of the global electrification trend and energy transition. Despite softer sample volumes, we have seen a persistent and structural change in demand for metals associated with battery storage and electrification, as evidenced in the performance of both our Geochemistry and Metallurgy businesses. The increased client demand for our industry leading high-performance method testing and value-added services has supported our strong market-share growth in downstream operations, leveraging our unique and distinct operating model of the Minerals division. This has enabled our Geochemistry business to successfully minimize the overall cyclicality of its earnings.”

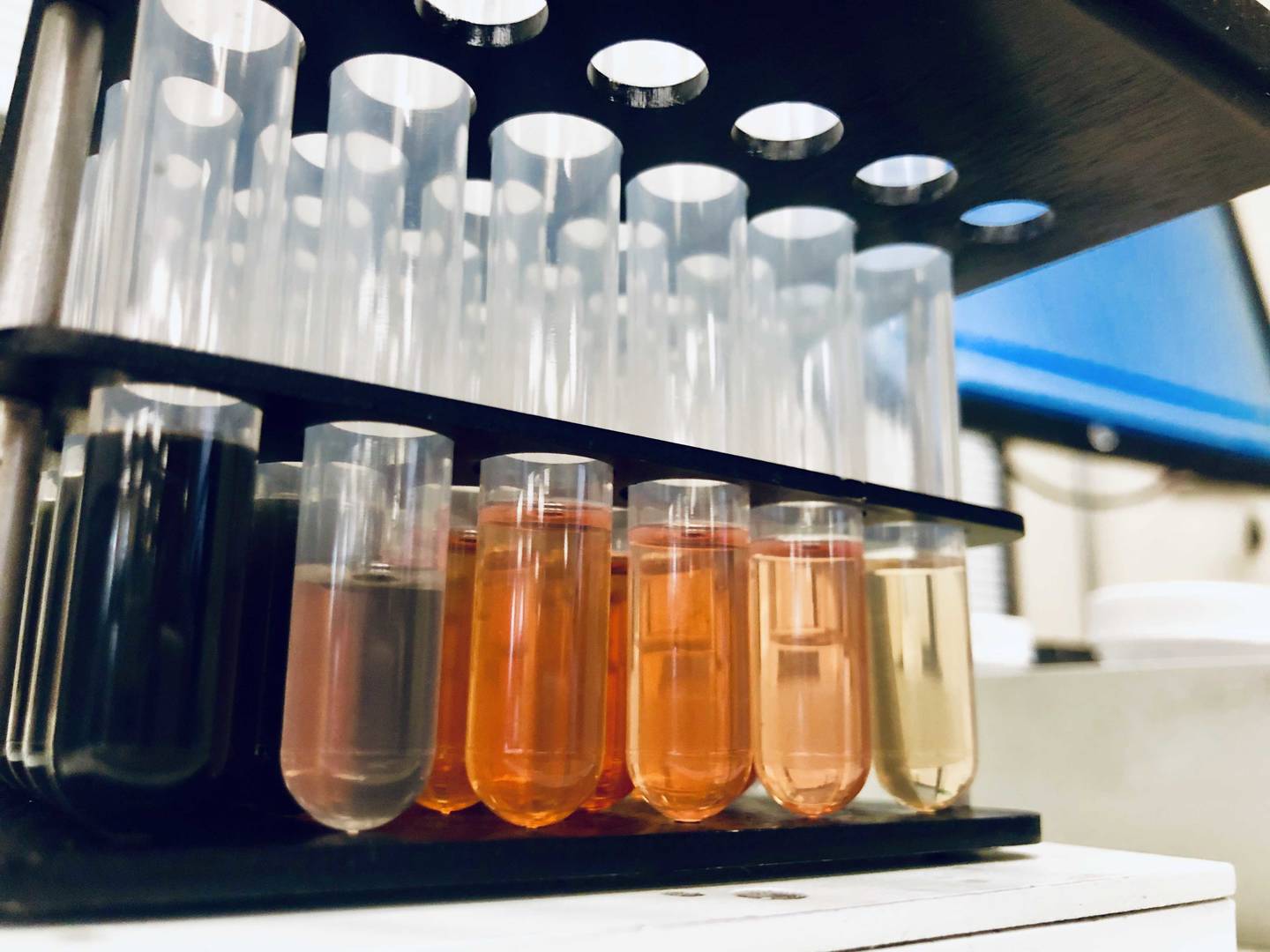

“Within Life Sciences, our Environmental business continued to deliver strong organic growth and margin improvement across all regions. The business has been able to demonstrate strong pricing discipline by leveraging its global scale, client value proposition, innovation journey and operational excellence. New regulations are expected to increase global demand for environmental testing services, for example PFAS testing, and our business remains well-positioned to capture this growth trend.”

”The Group has continued to make steady progress towards its long-term FY27 vision and financial objectives. We remain committed to the successful execution of this strategy. In addition, I look forward to exploring our strategy in further detail at our global investor day in 2024.”

Overview of H1 FY24 results:

Contributions from the Company’s divisions for H1 FY24 are summarised below:

Life sciences

Life sciences

Revenue growth of 12.7% with organic growth of 1.7%, scope growth of 4.5%, and a favourable currency impact of 6.5%. Growth was driven by good performance from the core Environmental businesses but partially offset by a slowdown in new product development revenues in the Pharmaceutical business. Excluding Nuvisan, organic revenue growth CCY was 5.0%.

Underlying EBIT decreased by 0.6% to $111 million, with the overall margin contracting to 14.9% due to impacts from economic conditions, geopolitical conflicts, and restrictive monetary policy inhibiting new product development. Underlying margin CCY (ex. Nuvisan) was 16.4%, down 117 bps, reflecting the challenging economic environment and reduced new product development for the underlying Pharmaceutical business.

Environmental business delivered high single digit organic growth across all regions, supported by market share growth in key geographies and successful price management. The Environmental business was able to expand margins during the period. Growth from emerging contaminants, e.g., PFAS, materially outpaced total market segment growth.

Food business delivered modest organic growth with volumes and margins recovering in the second quarter.

Pharmaceutical business was impacted by the reduced level of funding for new drug development, with financings normalising to pre-COVID levels. Excluding Nuvisan, organic revenue decline was 7.7%.

Nuvisan ALS’ 49% minority interest is under strategic review following a sustained period of underperformance from 2022 to date. The Group is reviewing: the long-term market outlook for the Contract Research Organisation (CRO) and Contract Development and Manufacturing Organisation (CDMO), the business structure and performance, and potential operational synergies within the existing Pharmaceutical portfolio. All potential ownership options are being considered, with a final decision expected in early calendar 2024.

The Life Sciences portfolio remains supported by sustainable global market segments, underpinned by industry megatrends such as increased regulations and outsourcing trends. The Environmental business is well positioned as a market leader to capitalise on emerging global contaminants following increased regulation across the globe. Both the Food and Pharmaceutical businesses, excluding Nuvisan, will continue to focus on their growth trajectory, with the size and scale of these global markets presenting significant growth opportunities.

Commodities

Revenue growth of 0.9% with organic decline of 0.4%, scope growth of 0.9%, and a favourable currency impact of 0.4%. Growth was limited in the period due to the expected lower levels of mining exploration following softer capital markets. Overall sample volume decline was partially offset by strong price management and an increased uptake of value-added services by our mining clients. All businesses excluding Geochemistry delivered strong organic growth.

Underlying EBIT increased by 0.2% to $161 million, with the overall margin contracting slightly by 18 bps to 29.6%, supported by the superior service offering of the Geochemistry business and continued growth of downstream activities.

Geochemistry had an organic revenue decline due to reduced sample volumes. The business was able to successfully minimise the impact of softer volumes in the period with good price discipline, increased uptake of premium value-added services, strong cost management, and effective capacity planning. Geochemistry margins were resilient in the period, remaining above 33%, a result of strategic growth in downstream activities and investment into innovation, such as high-performance methods.

Metallurgy achieved strong organic growth driven by the strong mining sector activity in energy and battery related metals, new project wins and overall market share gains. The pipeline of projects remains high particularly in testing services for battery related metals.

Inspection delivered impressive organic revenue growth due to strong global commodity trading activities and margin improvement through its cost discipline. It remains focused on global growth of commodity inspection and testing services.

alsglobal.com

Oil & Lubricants (formally Tribology) delivered strong organic revenue growth and positive margin improvement following successful implementation of cost control measures.

Coal had strong organic growth and margin improvement due to volume recovery in the period. Coal prices remain buoyant and the business remains focused on operational efficiencies and revenue growth. Coal EBIT represents ~1.5% of Group EBIT.

Capital management and balance sheet

The Group continued its disciplined and pro-active approach to capital management, balancing re-investment into growth both organically and through value-added acquisitions, returning capital to shareholders with dividends at the top of the payout range.

As at 30 September, the balance sheet remains strong with a leverage ratio of 2.0x, interest coverage ratio of 15.1x, and 73% of total drawn debt fixed at an average rate of 2.92%. In October 2023, the Group secured ~A$224 million of new US Private Placement (USPP) senior notes. The new USPP facility includes: 5-year bullet maturity, 3 currencies (EUR50 million, C$80 million and A$50 million) and weighted average cost of 5.65%. The new facility provides additional liquidity to the Group as it continues to execute on its growth strategy and eliminates the potential refinance risk in the short-term. The updated mix of debt by currency supports the existing natural debt profile hedge and cash generation in our main currencies. Following the issuance, 80% of drawn debt is fixed at 3.74% with a weighted average maturity greater than 5 years.

The Group has available liquidity of $486 million (as at 30 September 2023) and post USPP issuance, the Group available liquidity will increase to $580 million.

Interim dividend

Directors have declared an interim dividend of 19.6 cps, partially franked to 20% (H1 FY23 interim dividend: 20.3 cents, unfranked) representing a payout ratio of 59.9% of H1 FY24 underlying continuing NPAT, at the top end of the reference range (50 – 60% of underlying continuing NPAT). This dividend reflects the resilient H1 FY24 results and the current liquidity position. It will be paid on 14 December 2023 to shareholders on the register at 24 November 2023.

The existing $100 million share buy-back program remains active as a capital management tool and as such, the Board has determined not to offer a Dividend Reinvestment Plan. No shares were repurchased during the period under the buy-back program.

Investment in growth

Overall capex spend increased by $28 million in the year compared to the pcp as the Group invested in strategic organic growth opportunities across both the Life Sciences and Commodities divisions.

During the year, the Group completed 6 acquisitions (including 1 acquisition after 30 September), which are expected to generate approximately $36 million in revenue on a full-year run rate. The transactions were aligned to our long-term goal to capitalise on industry megatrends linked to sustainability and Life Sciences. Most transactions were focused within the Environmental sector, providing geographic expansion and new service offerings for the Group.

The acquisition strategy remains balanced and disciplined in current market conditions irrespective of the long-term FY27 scope growth objective. The Group remains focused on value-enhancing acquisitions and targeting opportunities that fit within existing capability frameworks or attractive adjacent markets. Bolt-on size transactions remain key to the overall acquisition strategy, noting that new transactions are likely to reflect the current size of the Group. The pipeline of opportunities remains supportive of the Group’s growth ambitions in key geographies and services.

Outlook

The medium to long-term outlook across both Life Sciences and Commodities remains strong. The Group’s portfolio is exposed to attractive end markets, underpinned by industry megatrends. The Company is well positioned to execute on its FY27 objectives which will capture sustainable structural growth opportunities.

The Group expects to deliver a FY24 underlying NPAT of between $310 to $325 million, representing a modest decrease of 1% (at the midpoint) to FY23. At a Group level, modest organic revenue growth is expected with a continued focus on effective price management. The Company expects to deliver further margin improvement into H2 FY24 within the Food and Pharmaceutical businesses, and to remain disciplined on executing value accretive transactions.

Within Commodities, the Geochemistry business to benefit from market share growth across the total value chain, maintaining overall margins above 30%. Increased uptake of high-performance methods and additional market share growth to support overall margin resilience. Metallurgy project pipeline remains strong, reflecting continued growth in demand for clean energy related metals and expected to deliver high single-digit organic growth and margin improvement YoY. Inspection and Coal volumes continue to improve YoY. Oil and Lubricants to deliver high single-digit organic growth and margin improvement for FY24. Remains focused on profitable market share growth and market penetration through greenfield start-ups.

Within Life Sciences, the Environmental business is expected to deliver mid to high single digit growth and further margin expansion, supported by additional market share expansion in key geographies, price management and improved efficiencies. Both Food and Pharmaceutical businesses will continue to focus on their growth trajectory. Food is expected to deliver mid to high single digit organic growth with margin expansion YoY. Pharma (excluding Nuvisan) to deliver volume and margin improvement in H2 with total YoY low single digit negative organic growth.

Approved for release by the Board of Directors. Download the asx/media release.

For further information please contact:

Investor Relations

ALS Limited

investor@alsglobal.com

About ALS Limited

ALS is a global Testing, Inspection & Certification business. The Company’s strategy is to broaden its exposure into new sectors and geographies where it can take a leadership position.

1 Based on underlying financial results for the continuing businesses, i.e. excluding Asset Care

2 All financial results compared to H1 FY23 unless otherwise noted

3 H1 FY24 NPAT guidance range was $150 to $155 million

4 TRIFR = 0.90* as at 30 September. *per million hour worked

5 2 transactions previously announced in May 2023 but occurring in the H1 FY24 period. 1 transaction signed post 30 September 2023