ALS Limited produces resilient H1 FY25 result despite mixed market conditions

asx/media release (ASX: ALQ)

H1 FY25 highlights1

- Underlying revenue2 of $1,464.2 million, an increase of 14.0% led by strong organic and scope growth within Life Sciences, contrasting softer growth conditions within Commodities.

- Underlying EBIT3 of $250.4 million, an increase of 2.1%. The operating margin declined to 17.1%, reflecting expected dilution from recent Life Sciences acquisitions and lower volumes in Minerals.

- Underlying net profit after tax (NPAT) of $152.3 million, declining 3.9%, impacted by the fluctuating exploration environment impacting Commodities, unfavourable FX impacts, and higher interest costs linked to recent acquisitions.

- Statutory NPAT of $126.8 million, declining 5.0%, reflecting integration and restructuring costs from recent acquisitions and the Nuvisan transformation.

- Minerals maintained resilient margin performance above 31%, with capacity in place to service any increase in volumes associated with future increased demand linked to global exploration activity.

- Integration of recent acquisitions on track, with Nuvisan slightly ahead in its transformation plan and showing good sales pipeline momentum.

- Strong balance sheet supporting growth agenda in line with value creation framework. Available liquidity of $375 million and EBITDA cash conversion of 91%4. Elevated leverage ratio following recent acquisitions with ongoing focus on improving working capital metrics and free cash flow generation to reduce net debt.

- Interim dividend of 18.9 cps (partially franked to 30%), representing a payment of $91.6 million to shareholders.

- Continued delivering leading safety performance

H1 FY25 financial results5

| A$ million | H1 FY25 | H1 HY24 | Change | H1 HY25 at CCY | CCY change |

| Underlying revenue | 1,464.2 | 1,284.5 | 14.0% | 1,505.9 | 17.2% |

| Underlying EBIT | 250.4 | 245.2 | 2.1% | 266.0 | 8.5% |

| Margin | 17.1% | 19.1% | (199) bps | 17.7% | (144) bps |

| Underlying NPAT | 152.3 | 158.4 | (3.9)% | ||

| Statutory NPAT | 126.8 | 133.5 | (5.0)% | ||

| Basic EPS (cents per share)6 | 31.4 | 32.7 | (4.0)% | ||

| Free cash flow generated | 274.3 | 235.6 | 16.4% | ||

| Underlying ROCE | 19.4% | 18.8% | 66 bps | ||

| DPS (cents per share) | 18.9 | 19.6 | (3.6)% | ||

| Net debt | 1,382.7 | 1,153.0 | 19.9% |

________________________________

2 Underlying revenue refers to ALS statutory revenue proforma adjusted in FY24 to proportionally consolidate the previous 49% share of Nuvisan revenues previously equity accounted.

3 Underlying profit measures are a non-IFRS disclosure and exclude unusual events and non-recurring items including acquisition-related and greenfield start-up costs, impairment and fair value gains/(losses), amortisation of separately recognised intangibles, SaaS system development costs, and other business restructuring and site closure costs.

4 EBITDA cash conversion calculated as cash flow before capex divided by Underlying EBITDA (adjusted for ROU lease assets)

5 The Groups’ Financial Statements include a contingent liability disclosure in relation to two proceedings brought by related Korean power entities against ALS subsidiary ACIRL in the Federal Court claiming losses said to be attributable to alleged discrepancies in the certified attributes of 11 coal shipments. Both proceedings continue to be vigorously defended

6 Basic EPS calculated as: Underlying NPAT / weighted average number of shares

Divisional review

Commodities| A$ million | H1 FY25 | H1 FY24 | Change | H1 FY25 at CCY | CCY change |

| Revenue | 553.7 | 545.1 | (1.7)% | 558.1 | +2.4% |

| Underlying EBITDA | 185.1 | 193.7 | (4.5)% | 194.5 | +0.5% |

| Margin | 34.5% | 35.5% | (99) bps | 34.9% | (67) bps |

| Underlying EBIT | 150.9 | 161.1 | (6.3)% | 159.4 | (1.1)% |

| Margin | 28.2% | 29.6% | (139) bps | 28.6% | (99) bps |

Revenue declined 1.7% vs pcp delivering modest organic revenue growth of 2.6% offset by an unfavorable currency impact of 4.1%. Despite the YoY sample volume decline of 0.5%, improved revenue mix through increased value-added services take-up and the growth of mine-site production activities combined to deliver net organic growth. Growth was limited due to the fluctuating sample flows linked to current subdued levels of global exploration and new project activity. During the period, juniors’ access to capital has remained constrained notwithstanding the record gold price and the long-term electrification megatrend.

Underlying EBIT decreased by 6.3% to $151 million, with the overall margin contracting to 28.2%. The adverse impact of the depreciation of the Canadian, US, Turkish and Latin American currencies vs the Australian dollar on reported EBIT was $8.6m. Underlying margins continue to be resilient reflecting reduced cyclicality, flexibility of the cost base and improved revenue mix.

Minerals organic revenue increased by a marginal 0.3%, an encouraging result amidst prolonged exploration activity flatness and associated sample volume decline of 0.5%. Geochemistry organic revenue grew by 2.7% through increased value-added services take-up and growth of mine site production testing, offsetting lower sample volumes. Metallurgy revenue and margin declined due to lower volumes, noting a record result in the pcp.

Industrial Materials delivered strong organic revenue growth of 12.2%, supported by market share and pricing growth within Oil & Lubricants and Coal. The Inspections business was in line with pcp.

Life Sciences

| A$ million | H1 FY25 | H1 FY24 | Change | H1 FY25 at CCY | CCY change |

| Revenue | 928.5 | 739.4 | +25.6% | 947.9 | +28.2% |

| Underlying EBITDA | 200.7 | 165.1 | +21.5% | 204.2 | +23.7% |

| Margin | 21.6% | 22.3% | (72) bps | 21.5 | (79) bps |

| Underlying EBIT | 133.7 | 110.5 | +21.0% | 136.4 | +23.4% |

| Margin | 14.4% |

14.9% |

(54) bps |

14.4% | (55) bps |

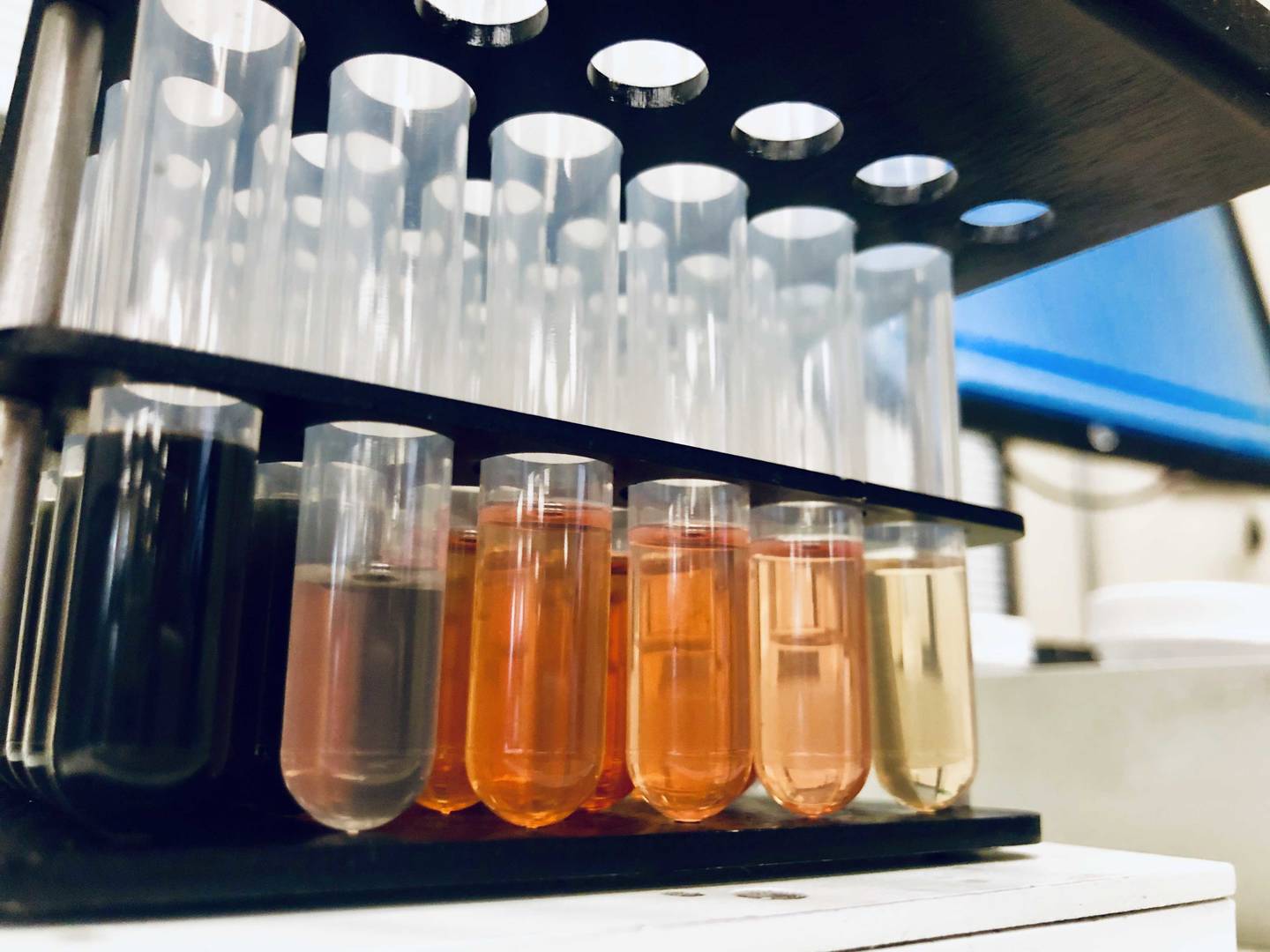

Revenue growth of 25.6% with organic revenue growth of 7.8%, scope growth of 20.4%, offset by an unfavourable currency impact of 2.6%. Growth was led by strong performances from both the Environmental and Food businesses, partially offset by mixed performance within the Pharmaceutical business.

Capital allocation, growth and balance sheet

The Group continued its disciplined approach to capital allocation.Interim dividend

Perspectives for FY25

The medium-to-long-term outlook for both Life Sciences and Commodities remains positive. The Group’s portfolio remains leveraged to attractive end markets, supported by industry tailwinds. The Group is well-positioned to execute on near-term financial objectives.- Targeting mid-single digit organic revenue growth for the Group.

- Excluding acquisitions, solid improvement in operating margins for Life Sciences

- Continued margin resilience in Minerals.

- Risk-weighted growth prioritisation to Environmental and Minerals businesses, in-line with the value creation framework.

- Focus remains on integration of recent acquisitions and Nuvisan transformation program.

- Leverage to remain at the top end of targeted range with intention to reduce to mid-point in the next 12–18 months.

Authorised for release by the Board of Directors.

For further information please contact:

Group Treasurer, Investor Relations & Business Integration Director

michael.williams@alsglobal.com

M: + 61 409 001 308

ALS Limited

A global leader in testing, ALS provides comprehensive testing solutions to clients in a wide range of industries around the world. Using state-of-the-art technologies and innovative methodologies, our dedicated international teams deliver highest-quality testing services and personalized solutions supported by local expertise. We help our clients leverage the power of data-driven insights for a safer and healthier world.